Human workforce is the great asset of every business that company suffers if they do not perform well and wins if they do. To achieve whatever company goal is, employers are obliged to take care of its manpower by giving them proper benefits and privileges as mandated by the government. This is to ensure job satisfaction and increase work performance for positive result or impact to the company aside from their weekly or monthly wage.

Support Staff in the Philippines abide the benefits as mandated by the Department of Labor to our employees such as:

- Mandatory Government Contributions

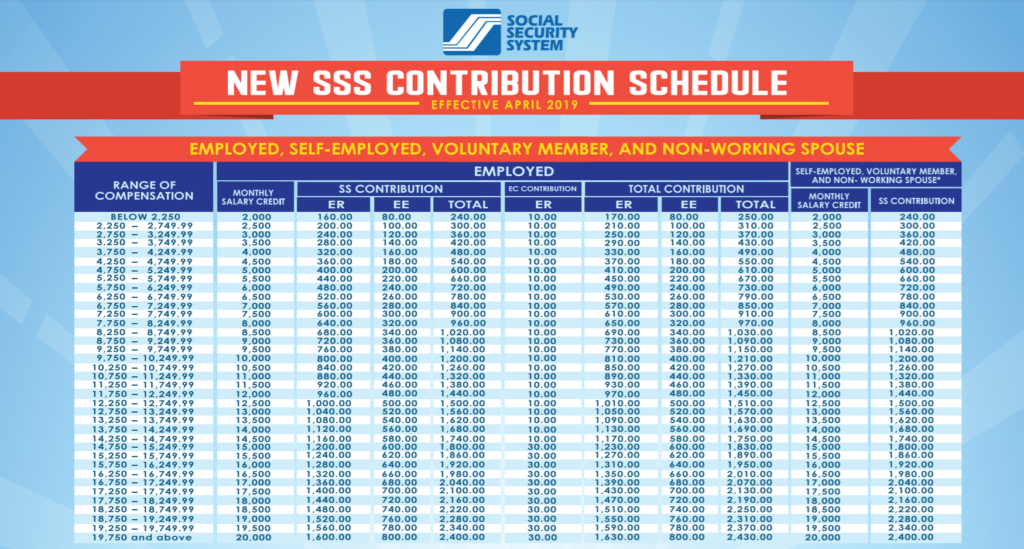

- Social Security System (SSS)

Insurance program set by the government for all wage earners in the private sectors where members are required to contribute a certain amount depending on salary bracket.

ER – Employer

EE – Employees

Of the 12% contribution rate, the employees pay 4% through monthly salary deductions while the employers shoulder the remaining 8%.

As member of SSS, employees are automatically entitled to these benefits:

- Salary Loan

- Sickness/Maternity/Paternity

- Disability

- Retirement

- Death

- Unemployment

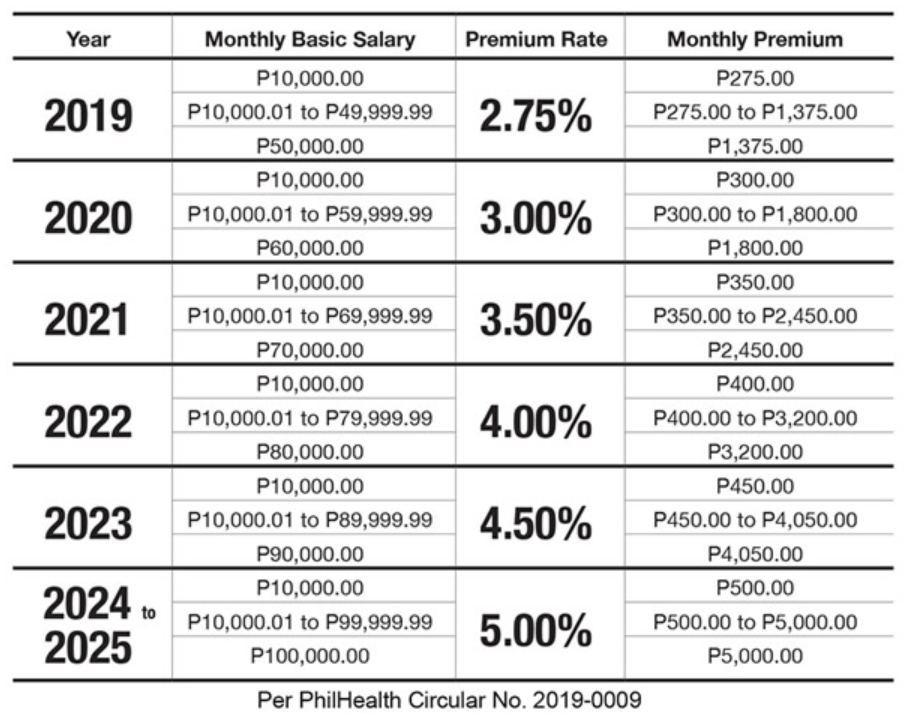

- PHILHEALTH

Health insurance program for private employees providing financial aid and services for health care.

The computation starts at 2.75% of the basic salary per month, and the payment is equally shared by employer and employee.

Sample computation:

Benefits includes:

- Inpatient (hospitalization, facility fees, and physician/surgeon fees)

- Outpatient (day surgeries, radiotherapy, hemodialysis, outpatient blood transfusion, primary care benefits)

- Z benefits (financial/medical aid for the patients with cancer and in need of surgeries

- SDG related (Malaria package, HIV-AIDS package, anti-Tuberculosis treatment, voluntary surgical contraception procedures, and animal bites treatment)

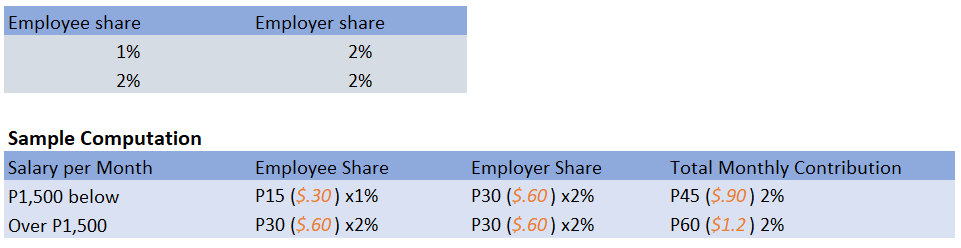

- PAG-IBIG (Home Development Mutual Fund (HDMF))

The PAG-IBIG contributions are shared by employees and employers.

These 3 employees’ government mandatory share of contribution is deducted from the monthly salary while employers pay their share of contribution for every employee where this amount must not be deducted from employee’s salary.

Other Employees Benefits

- Overtime

- Premium Pay

- Holiday Pay

- Night Shift Differential

- Service Incentives Leave

- Parental Leave

- 13th Month Pay

- Separation Pay

- Gross Benefits & De Minimis

In my next blog, I will define and explain in detail what these benefits are because we will be talking about the holidays in the Philippines and other non-governmental but company discretion incentives and bonuses benefits.

Anyways, from the above perspective, the contribution of both employees and employers are very affordable so that every BPO company in the Philippines can provide what is right for the employee. Support Staff abide by the implementing guidelines on labor laws that make a comfortable and happy workplace, honesty, and transparency to our employees. Want to partner with us not just as clients but partnership, send us a message at customer.service@supportstaffph.com or click here.